Cash Back Cards

Posted on 16th May 2023 at 11:36

Get upto 2 months FREE energy AND all your Christmas food shopping FREE!

Shop smart and make your money go that bit further by getting cash back on your purchases - work out the best places to go and the best cards to use ...

Play the system with cashback cards - the more the merrier I say!

Before I go shopping I spent a few minutes working out which is the most effective way to do things in order to get the maximum benefit ... The first time may take you a little longer as you identify the best fits for each card and combination but once you have just keep a note of them and then it only takes a few minutes thereonafter!Myself personally, I have the following :-

Online Discount Clubs

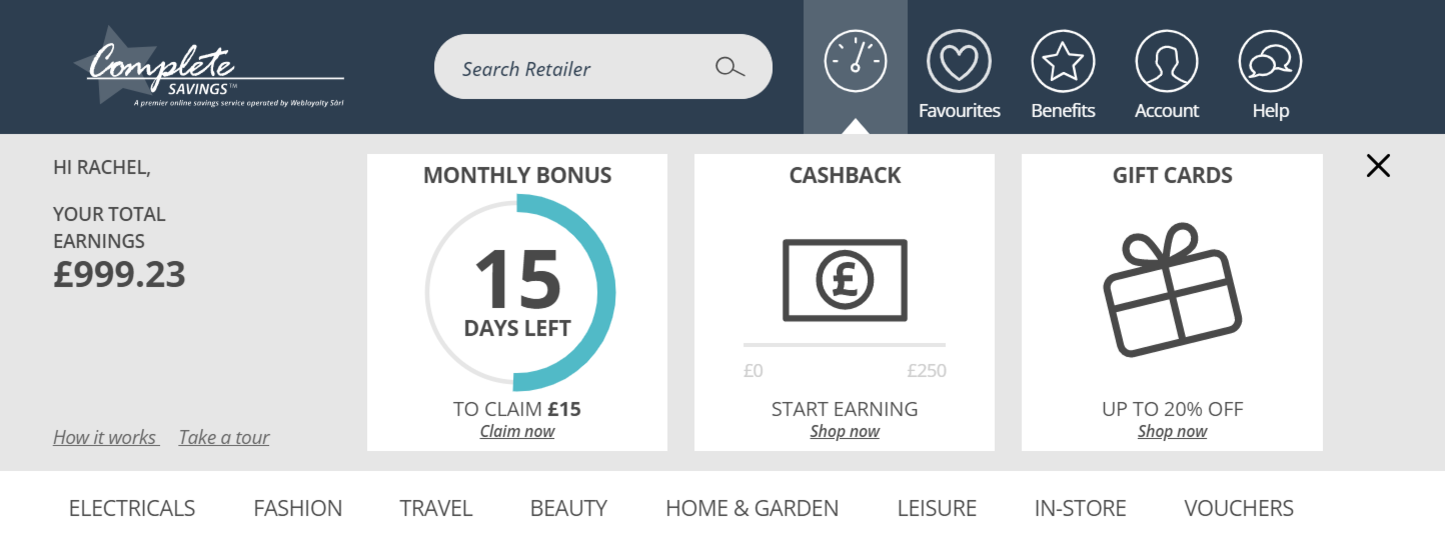

My favourite two are Complete Savings (www.completesavings.co.uk) and Top Cashback (www.topcashback.co.uk).

You connect to the partner websites through the online discount club website, it then tracks your purchase and details are sent from the purchase site back to online discount club. It identifies your account via the email address and voilà - your cashback is added to your account and they payout once a month directly back to bank account from which they draw the subscription direct debit.

Complete Savings discount membership does charge £15 pcm, however, any purchase in a single month you can manually submit your receipt on their system and you get the £15 back in cash to your bank. The discount ranges from 10%-25% and covers a massive range from home and garden products to food, days out and entertainment and shopping.

As you can see, I’ve received just over £999 in cash back in the last 18 months since I started using Complete Savings AND I can comfortably say that this has also generated a further £60+ in savings on my energy bills too!

Top Cashback is free to use but the savings are lower.

Points Based Loyalty Cards

Boots

Sainsburys

M&S Sparks Card

Cafe Nero

Each loyalty card earns points when you pay at counter which can be saved and swapped for vouchers or products. In-fact, M&S chooses someone at random on a regular basis when they scan their Sparks card at the counter and gives them their shopping for free! I didn’t know anything about this until the till starting pinging and it sounded like I’d hit a Vegas jackpot bringing the store to a standstill. This happened to me when buying some clothes at the M&S Outlet mall in York, saved me £76 and really made my day!

American Express

Utility Warehouse (UW)

Cashback Payment Cards

As my energy is with Utility Warehouse, I have the UW cashback card.

I know, for example, my dogs eat a very specific hypo-allergenic dog food which is only available at Pets at Home or online. So, I can go to them via my Complete Savings discount site which will then give me 10% cashback to my bank PLUS if I pay with my UW card then I’ll get a further 1% discount knocked off my next utility bill as well! Not to mention that this monthly purchase is also my ticket to getting my monthly £15 subscriptin fee back too!

From Complete Savings online I also buy a £100 One4All digital giftcard every month with a 20% discount - so only pay £80 - it always gets used in local shops but every purchase on it gives me the added bonus of a 20% discount because of the original purchase price. PLUS when I pay for it using my UW card I also get 1% cashback off my utility bill - double bubble - win win!

Sainsburys is a UW partner who offers 3% cashback so I tend to do most of my shopping here, collect my nectar points AND if I pay with my UW card I also get 3% cashback of my next utility bill - it’s amazing how soon it all adds up.

American Express isn’t taken everywhere but if you have the app downloaded on you phone, keep an eye out on the offers. You’ll regularly see things like £20 cashback on £50 of fuel at Shell or something similar which is very helpful or special offers a Pizza Express and similar places. They are also proud supporters of the ‘shop local’ campaign and regularly run £5-£25 cashback on local purchase events.

Every month I have £20-£65 discounted off my utility bill because of the cashback levied using my UW card and all for just buying the stuff I would be buying anyway! In total, I have earned in excess of £400 cashback in the last 12 months off my energy bills for making purchases I would have done anyways!

Between my Utility Warehouse card, Complete Savings and American Express card, I save on average £125-£150 a month plus ... and that doesn’t include my loyalty points which I let build up all year and then use to pay for most of my Christmas food shopping and several Christmas presents too!!!

If you would like help to get similar monthly discounts off your shopping and utility bills please get in touch.

Call Rachel on 01423 228 500

or 07986 731 291 or email

info@moneysavingnetwork.net

Share this post: